A Universal Account Number ( UAN Number) is a 12-digit identification number used to track your EPF contributions and investments. It is issued by the Ministry of Labour and Employment and managed by the Employees’ Provident Fund Organisation (EPFO). Your EPF account is linked to your UAN to make withdrawals, transfers, and other EPF processes easier.

The goal of our platform — UAN Portal (uanportal.com) — is to help you understand everything about your UAN and how to manage your EPF account effectively.

Why UAN Login Portal is Important?

UAN serves as an umbrella for multiple Member IDs allotted to an individual by different employers. With UAN, managing EPF accounts becomes seamless. It centralizes information, ensures transparency, and enables faster access to services like withdrawals, balance checks, and claims. It also allows employees to keep track of their employment history and EPF contributions in a unified way.

Without a UAN, it becomes cumbersome to track multiple PF accounts from past employers. UAN links all your previous and current employers under one roof, improving service delivery and reducing paperwork. In the long term, it promotes financial discipline and helps employees plan their retirement better.

Our website, uanportal.com, simplifies these processes by offering step-by-step guidance, useful tools, and clear instructions on how to make the most of your UAN.

| Feature | With UAN | Without UAN |

|---|---|---|

| View PF balance | ✔ | ❌ |

| Online withdrawal | ✔ | ❌ |

| KYC updates | ✔ | ❌ |

| Transfer PF online | ✔ | ❌ |

What is a UAN Number?

The term UAN (Universal Account Number) refers to a unique number that stores information about all the Member IDs linked to an employee.

The Universal Account Number (UAN Login) is a unique 12-digit identifier assigned to every employee contributing to the Employees’ Provident Fund (EPF) in India. Managed by the Employees’ Provident Fund Organisation (EPFO),

EPFO generates two separate UAN-related numbers—one for the employee and one for the employer. When you join a new company, a new Member ID is created and linked to your existing UAN. Once issued, your UAN never changes, even if you switch jobs. You only need to inform EPFO whenever you move to a different organization.

Getting Started: How to Register and Activate Your id on UAN Portal

To use the UAN portal, the first step is to activate your UAN. Activation ensures that you can log in and utilize the portal’s services. This is a mandatory process for all EPF members who wish to manage their accounts online.

Steps to Activate Your UAN:

- Visit the UAN Portal: Navigate to https://unifiedportal-mem.epfindia.gov.in/.

- Click “Activate UAN”: This option is available on the bottom right of the login section.

- Fill in the Details:

- Enter your UAN or Member ID (you can find this from your employer or pay slip).

- Provide your Aadhaar or PAN (used for KYC verification).

- Input your full name, date of birth, and registered mobile number.

- Receive OTP: An OTP will be sent to your mobile number linked with Aadhaar.

- Enter OTP and Submit: Once verified, you will be prompted to create a password.

- Login Credentials Created: Use UAN and the password you created to log in to the portal.

Ensure your mobile number is accurate and Aadhaar is linked to avoid activation errors. Once activated, your profile gets unlocked for managing EPF accounts efficiently.

UAN Login Guide: Easy Access to the Member e-Sewa Portal

After activation, you can easily log in to manage your EPF account using the UAN Member e-Sewa Portal. This portal is the digital gateway to all your PF-related transactions and information.

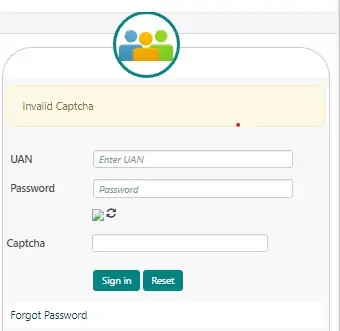

Login Process:

- Visit the UAN Member Portal.

- Enter your UAN id and the password you set during activation.

- Type in the CAPTCHA and click “Sign In.”

Dashboard Features: Upon logging in, you’ll have access to several useful features:

- View and Download Passbook

- Service History Tracking

- KYC Details and Status

- Profile and Contact Information

Forgot Password?

- Click on “Forgot Password”

- Enter your id and the CAPTCHA code

- You will receive an OTP on your registered mobile

- Enter the OTP and reset your password easily

It’s advisable to log in frequently to verify your monthly contributions and update personal information. This helps detect discrepancies and maintain an error-free record.

Explore UAN Portal Services

The UAN portal is a one-stop platform for managing all your EPF-related services. It streamlines access to essential tools and documents required for PF tracking, withdrawals, and administrative changes.

| Service | Description |

| PF Balance Check | Instantly view your current EPF balance online |

| Download Passbook | Access a PDF copy showing monthly contributions & interest |

| Update KYC | Link and verify documents like Aadhaar, PAN, and bank account |

| PF Withdrawal | Apply for full or partial withdrawal online |

| PF Transfer | Move your EPF funds from previous to current employer seamlessly |

| Claim Status | Track updates on submitted PF claims |

The portal also allows you to access grievance services, download important forms, and update your contact details. Utilizing these services ensures transparency and reduces dependency on intermediaries.

How to Link Aadhaar with UAN?

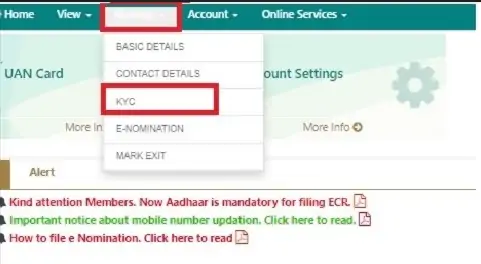

Once You are in EPF Login Account, You have to enter your details in UAN portal. Follow below mentioned steps to link your UAN with Aadhaar Card:

- Login to your EPF account by visiting the EPFO member home page

- Click on the “KYC” option in the “Manage” section

- Now enter your 12-digit Aadhaar number and name

- No,w click on the “Save” option

- Your request will appear under “KYC Pending for Approval.”

- After UIDAI confirms your details, your current employer’s name will appear under “Approved by Establishment” and your Aadhaar number will appear under “Verified by UIDAI.”

Documents Required for UAN Activation

Following documents have to be provided at the time of UAN activation (this is usually taken from you by your employer when you join the service):

- Aadhaar card

- PAN card

- Bank account details and IFSC

- Any other proof of identity or address, if required.

Ensure details match across all documents to avoid rejection. Always confirm the employer has approved the update.

PF Balance check with UAN/without UAN

You can check your PF balance in several ways, whether you have your UAN or not.

If you have a UAN, you can view your PF balance through:

- The EPFO online portal

- The UMANG mobile app

If you don’t have your UAN, you can still check your PF balance by:

- Sending an SMS to 7738299899 from your registered mobile number in this format: EPFOHO UAN ENG

- Giving a missed call to 9966044425 from your registered mobile number

How to Withdraw Your PF Amount Online?

You can apply for full or partial PF withdrawal online without visiting the EPFO office. The digital process is convenient, fast, and secure.

Types of Withdrawals:

- Final Settlement: After resignation or retirement

- Partial Withdrawal: For education, marriage, medical emergencies, etc.

- Advance Claim: Due to COVID, calamity, or natural disaster

Steps to Withdraw Funds:

- Login to UAN Portal

- Navigate to “Online Services” > “Claim (Form-31, 19, 10C & 10D)”

- Verify your KYC and enter the last 4 digits of your bank account

- Select the type of claim (e.g., PF Final Settlement, Pension Withdrawal)

- Fill in the form and submit

Eligibility Table:

| Purpose | Min. Service Required | Withdrawal Limit |

| Marriage | 7 years | 50% of employee share |

| Medical | No limit | Up to 6 months of basic + DA |

| Home Loan | 5 years | 90% of PF balance |

You can track claim status under the “Track Claim Status” tab. Ensure your bank account and PAN are up-to-date to avoid rejection.

Switching Jobs? Here’s How to Transfer Your PF From UAN Portal

Transferring your PF to your new employer helps consolidate your accounts and maintain your interest earnings. It ensures you don’t lose track of your funds and minimizes paperwork in the future.

Why Transfer PF?

- Ensures continuous EPF contributions

- Keeps the interest compounding on a larger balance

- Avoids dormant accounts

- Prevents multiple UANs from being created

Steps to Transfer Your PF Account:

- Login to UAN Portal

- Go to “Online Services” > “One Member – One EPF Account (Transfer Request)”

- Verify personal details and PF numbers

- Choose your previous or current employer to attest the transfer

- Submit and download the PDF copy

- Send it to the employer if required

Processing takes a few days and you can check progress under “Track Claim Status.” Always ensure previous employer’s exit date is updated before initiating the request.

How to Change/Update Personal Details on UAN Portal?

Employees can update their personal information such as name, date of birth, mobile number, and email ID by logging into the UAN portal. It’s important that the details match those on the Aadhaar card; otherwise, the UAN portal will not accept the changes.

Updating your mobile number or email ID does not require employer approval. Once verified through an OTP, the update is completed instantly.You can also add or modify your bank account details in EPFO. However, these changes must be digitally approved by your employer before the bank account is officially linked to your UAN.

Key Features & Benefits of UAN

Below are some of the major features and benefits of the UAN:

- Acts as a single universal identity that remains the same throughout an employee’s professional life.

- Allows all PF accounts from different employers to be linked under one UAN, making it easier for EPFO to track job changes.

- Enables access to various online EPF services, including downloading the UAN card, viewing/updating personal details, and managing KYC information.

- Provides convenient online options for PF passbook download, claim submission, and KYC updates.

- Enhances transparency by letting employees monitor employer PF contributions.

- Speeds up and simplifies PF withdrawals and transfers, with the ability to track claims in real time.

- Improves verification and tax-related processes by linking UAN to Aadhaar, PAN, and bank account details.

- Offers an e-nomination facility for smooth and faster settlement of PF funds.

- Minimizes dependency on employers for PF-related tasks.

- Strengthens security and reduces fraud risks through proper KYC verification.

Troubleshooting Common UAN Portal Issues

Users may face issues while using the portal. These can range from login problems to incorrect personal details. Timely resolution ensures a smooth experience.

| Issue | Solution |

| Forgot UAN | Use the “Know Your UAN” link with PAN or Aadhaar |

| UAN not linked to mobile | Visit nearest EPFO or raise a grievance online |

| Name/DOB mismatch | Submit a joint declaration form through your employer |

| KYC “Pending” for days | Remind your employer to approve submitted details |

If your issue is unresolved, raise a grievance through EPFiGMS or reach out to the EPFO UAN Login or EPFO office directly. Keeping records like salary slips and UAN communications handy helps in speedy redressal.

Frequently Asked Questions (FAQs)

Can I have more than one UAN?

No. Only one UAN is allowed per individual. If you have multiple, you must request a merge.

How can I check my PF balance without UAN Login?

Send an SMS: EPFOHO UAN ENG to 7738299899 from your registered mobile.

Is it necessary to update KYC every time I change jobs?

No. Once your KYC is approved, it remains valid across jobs under the same UAN.

How long does a PF claim take to process?

Online claims are typically settled within 5 to 15 working days.

Can I withdraw PF while employed?

Partial withdrawals are allowed under specific conditions (e.g., medical, education).

What happens if I forget my UAN Login password?

Use the “Forgot Password” link on the login page to reset it using OTP verification.

Can I use UAN services from a mobile device?

Yes. The UAN portal is mobile-friendly and EPFO also offers an app for Android devices.

Need Help? Here’s How to Contact EPFO Support

If you face any technical or process-related issues, the EPFO provides multiple support options. These are designed to help employees access accurate information and resolve problems quickly.

EPFO Helpdesk:

- Toll-Free Number: 1800-118-005

- Email: employeefeedback@epfindia.gov.in

- Online Grievance Redressal: Visit https://epfigms.gov.in/

Locate EPFO Office:

- Use the “Office Locator” at https://www.epfindia.gov.in/

Live Support:

- EPFO’s official website offers live chat and WhatsApp assistance during working hours.

Tips for Getting Support Faster:

- Keep your UAN, Aadhaar, and employer details ready.

- Explain your issue clearly with any screenshots or documents.

- Use online grievance tools for a trackable complaint ID.

Don’t hesitate to follow up if you don’t get a response within a few days. Persistent follow-up ensures your query gets the attention it deserves.